UK-based oil and gas company Zephyr Energy (LSE: ZPHR) has attracted a lot of positive attention in recent years. And with its share price down 27% year-to-date, this penny stock looks like a potential bargain to me at less than 5p. But is it really?

Ups and downs

Penny stocks are among the riskier investments I could make in the stock market. I’ve been looking recently at Zephyr Energy, a British firm that drills for oil and gas in the Rocky Mountains in the US. The company has only a £72m valuation, which means its share price can be volatile.

This was plain to see from what happened a couple of years ago. Between June 2020 and August 2021, shares in the firm jumped from 0.43p to 6.3p for a return of 1,300% on an investment. I’d never expect one of the FTSE 100 giants to give me a 13 times return on my money in less than a year.

Should you invest £1,000 in Zephyr Energy right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Zephyr Energy made the list?

On the other hand, if I’d bought in at 3.75p in June 2018, I’d have been licking my wounds after a heavy 88% loss when the price dropped to that 0.43p mark.

While these ups and downs mean that I’d never invest too much in penny stocks, I’m always on the lookout for a small stake if I can see good value.

A company that’s growing

Zephyr Energy’s latest earnings report shows a company that’s growing fast. Revenue of $42.9m for full-year 2022 didn’t just beat the guidance of $35m-$40m, but was a seven-fold increase on 2021 revenues of $6m.

And most importantly, the year-on-year revenue growth of over 600% was linked to production growth of over 500%. So I’m not looking at a temporary boost due to increased oil prices.

The AIM-listed company is geared towards further growth too, which would be a positive sign should I decide to open a position in the stock myself.

That growth will be spearheaded by six new wells that should be open by June and a predicted number of barrels of oil (or equivalent) that are predicted to reach 1,550-1,750 per day in 2023. That figure is up from 1,490 in 2022.

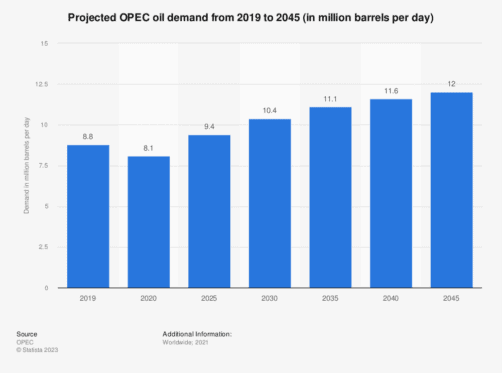

Looking longer term, this graph from Statista shows that oil demand from OPEC countries – oil making up 86% of Zephyr Energy’s output – is predicted to rise significantly in the decades ahead.

The long-term risk here is worldwide demand for oil lessening as fossil fuels are phased out. I wouldn’t want to be holding this type of stock if that happens sooner than expected.

Am I buying?

On the whole, increases in revenue and good news on the horizon make Zephyr Energy a penny stock I’ll consider buying soon. The long-term risks with the oil and gas industry do mean I’m not sure I’d place it firmly into bargain territory, however.